The most advanced Check printing solution for Windows and AS/400 iSeries systems.

Interfaces seamlessly with most check printing and accounting software including Oracle/PeopleSoft, SAP, JD Edwards, HTE, MAS 2000, MAS 90, IVAS, Timberline, EnterpriseOne, Yardi, MYOB, Peach Tree, QuickBooks, and many more.

ChequeSuite Provides the Leading Edge Technology of Combating Check Fraud.

Benefits:

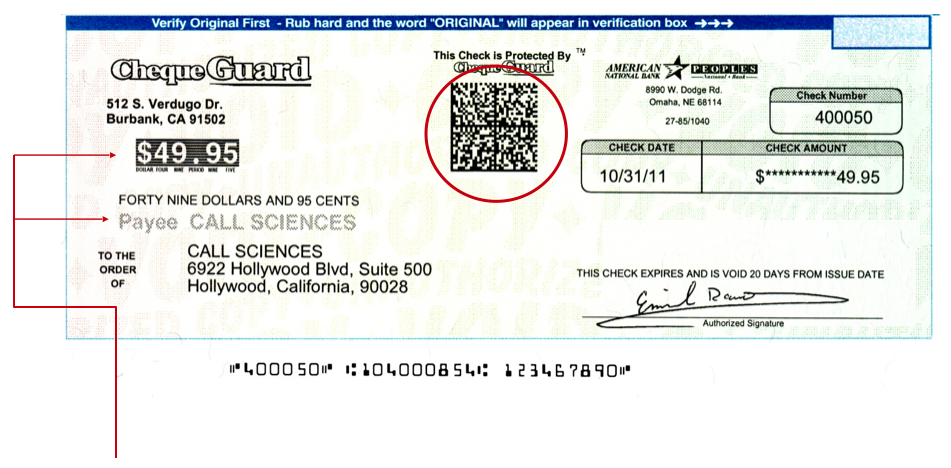

SecureSeal is laser printed barcode technology created to stop check fraud. Counterfeit and altered checks, including checks with added payee names, can be detected.

Eliminates the need for pre-printed check stocks Prints checks on blank check stock for all accounts and divisions in one run. No more switching forms in the printer between accounts/divisions.

Flexibility and Versatility:

''Easily integrated into your existing applications.

''Handles multiple bank accounts, and companies.

''MICR line control to meet American Banking Association (ABA) standards.

''Supports E13B and CMC-7 MICR fonts.

''Supports letter and legal size check stocks and up to four-up checks.

''Supports multiple fonts and font sizes.

''Supports Bar Code fonts such as 3 of 9, 128, UPC, etc.

''Supports multiple laser printers for faster process.

''Automatic collating checks and statements even from different spool files.

''Prints the check amount using secure font.

''Prints the overflow data on plain paper automatically drawn from a secondary printer drawer and prints the overflow pages directly behind the check, even if the data in a separate file.

''Reprint function allows printing damaged check(s) only by authorized users.

''Multiple signature control levels gives you the control to print different signature(s) based on the check amount or not to print signature at all.

''Converts ZIP+4 to POSTNET bar code so you can take advantage of the postage discounts.

''OMR capabilities to control folding/inserting machines such as NoePost, Pitney Bows and Bowe.

''ACH File Creation Module.

''Positive Pay and Positive Pay with Payee Name Module.

Security:

Multiple security levels. User defined groups and tasks, so the system administrator can set the user profiles to specific system functions.

Customized Job Audit Log Report, showing check information, user, time and date printed and re-printed.

ChequeSuite system is designed with fraud prevention in mind, and includes several levels of controls to protect against outsiders or unauthorized employees from compromising the system and making unauthorized payments.

ChequeSeal: State-of-the-art encryption technology that 'seals' check information to the check. This includes the payee name, dollar amount, check number, issue date, routing and account numbers, and the X,Y coordinates of each data field. It also contains the ID of the employee who printed the check, date and time the check was printed, and the printer used to print the check into the encrypted barcode. The barcode can be customized to include Claim Number or any other data to help in reconciliation or data processing.

Secure Fonts:

Secure Fonts: The payee name and dollar amount are virtually tamper proof when the checks are printed with high quality toner, a hot laser printer, and high security checks with toner anchorage.

Digitized Signature Control: The system can print digitized facsimile signatures. The System Administrator controls what signature or combination of signatures appear at pre-determined dollar amounts. One option deletes the signature on large dollar checks. ChequeSuite' can sort the unsigned checks to print first, out of sequential order.

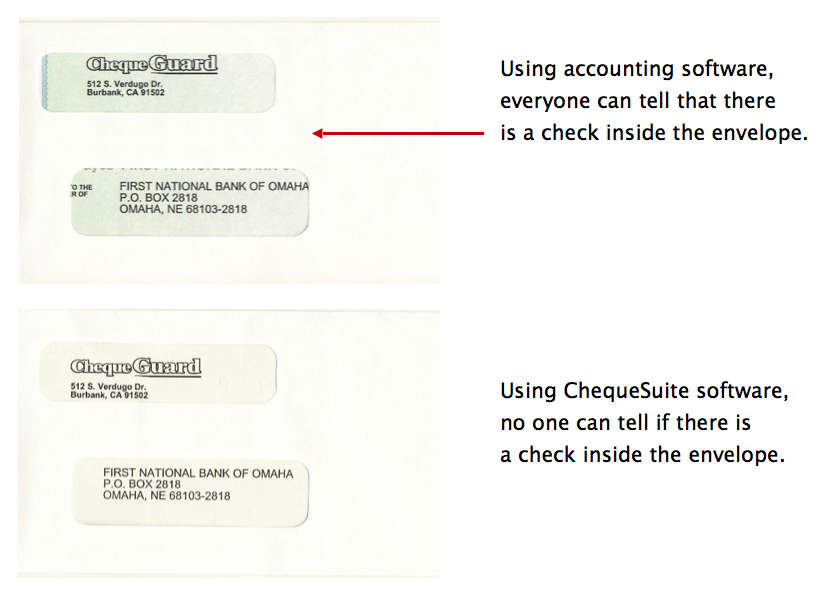

Payee Name and Address Printed on Stub: To reduce the risk of checks being stolen from the sender or recipient's mail room, or US Post Office, the payee name and address can be printed on the white stub as well as on the check. The check is inserted into the envelope with the white stub showing through the window envelope, not the check. While printing the payee name and address on the stub reduces the available remittance data area, it helps reduce the risk of mailed checks being identified during the mail process, stolen and compromised.

Remittance Data Overflow:

Remittance Data Overflow: When the remittance detail for the check exceeds the available lines on the stub, the overflow prints on plain white paper pulled from a second print tray. It does not print on voided check stock. The additional white pages can be barcoded for auto-collating and stuffing.

Office File Copy: The system includes a feature that allows copies to be printed to any laser printer on the network.

Manual Check Module for individual checks to be printed on-demand and entered into the accounting system later. This module can be enabled and restricted to specific users, or disabled by the System Administrator. These manual checks are automatically captured in the Positive Pay file.

Re-Print Function includes the option to re-print a live check; or a copy of a check issued earlier.

Payee Positive Pay issue file is automatically created and can be automatically sent to a bank.

ACH/Electronic Funds Transfer (EFT) is designed to save time and money by printing checks and ACH payments in a single 'check disbursement' run. The default in the ChequeSuite system is to print checks. However, if the vendor is set up to receive an ACH payment, the internal ACH path is followed.

History Log: Auto-records all activities including user ID, date and time, and check information.

User Defined Security Access: The System Administrator decides who has authority to perform which functions.